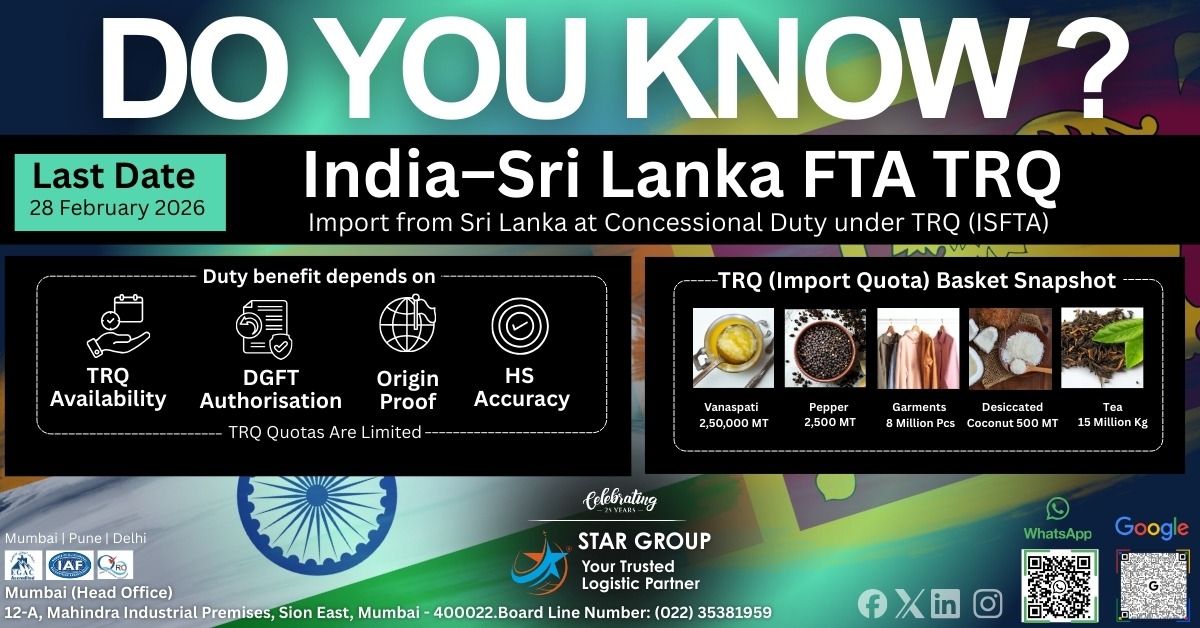

HS Code | Commodity (as per DGFT TRQ list) | TRQ quantity (Final) | Actual tariff rate (BCD) – Effective rate | Concessional tariff rate under TRQ (BCD) – Final |

39011010 | Linear low-density polyethylene (LLDPE), in which ethylene monomer unit contributes 95% or more by weight of the total polymer content | 105,000 MT | 7.5% | 3.75% |

39012000 | Polyethylene having a specific gravity of 0.94 or more | 285,000 MT | 7.5% | 3.75% |

39014010 | Linear low-density polyethylene (LLDPE), in which ethylene monomer unit contributes less than 95% by weight of the total polymer content | 105,000 MT | 7.5% | 3.75% |

39019000 | Other polymers of ethylene, in primary sources | 25,000 MT | 7.5% | 3.75% |

39021000 | Polypropylene | 158,500 MT | 7.5% | 3.75% |

39023000 | Propylene copolymers | 112,000 MT | 7.5% | 3.75% |

39029000 | Other polymers of propylene or of other olefins, in primary forms | 9,500 MT | 7.5% | 3.75% |

39041010 / 39041020 / 39041090 | PVC resins (Emulsion grade / Suspension grade / Other Poly(vinyl chloride)) – Cumulative annual TRQ | 60,000 MT (cumulative annual) | 10% | 5% |

71081200 / 71081300 | Non-monetary gold (unwrought / semi-manufactured forms) | 200 tonnes | 10% | 1% absolute duty reduction over applied rate |

71131910 | Articles of jewellery of gold (unstudded) | 2,500 kg | 20% | 15% |

74081110 | Copper weld wire, cross sectional dimension > 6mm | Moving average of Years 6–8 (in MT) | 5% | 0.0% |

74081910 | Copper weld wire, cross sectional dimension < 6mm | Moving average of Years 6–8 (in MT) | 5% | 0.0% |